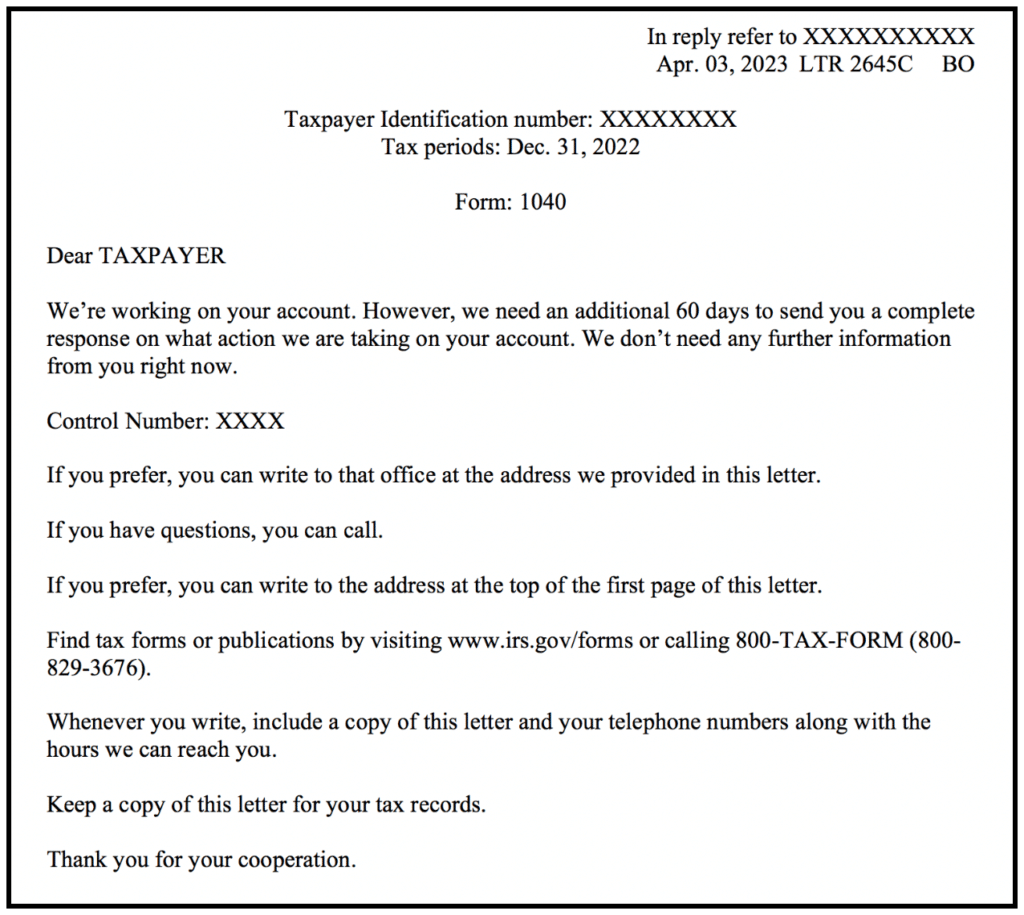

Is letter 2645c an audit – Ever heard of Letter 2645c? It’s like the mysterious guest at the accounting party – everyone whispers about it, but nobody really knows what it does. Is it a friendly audit, a sneaky audit, or just a letter that likes to wear a fancy suit?

Let’s dive in and see what this letter is all about!

Letter 2645c is actually a big deal in the world of finance and auditing. It’s a specific regulation, like a rulebook for how companies should handle their financial information. Imagine it as the boss of all the numbers, making sure they behave and follow the rules.

This letter, however, is more like a strict, but fair, teacher, making sure everyone understands the importance of doing their homework. It’s all about transparency and accountability – no fudging the numbers allowed!

Understanding Audit Letters

Audit letters are essential documents in the world of accounting and finance. They serve as a formal communication channel between auditors and the management of an organization. Their primary purpose is to provide information, request data, and clarify specific matters during the audit process.

Types of Audit Letters

Audit letters can be categorized based on their specific purpose and the stage of the audit process. Here’s a breakdown of common types:

- Engagement Letters:These letters formally Artikel the scope and objectives of the audit engagement. They establish the responsibilities of both the auditor and the client, including the agreed-upon audit procedures and reporting requirements.

- Confirmation Letters:These letters are used to verify information directly with third parties, such as banks, customers, or suppliers. They are essential for obtaining independent evidence and ensuring the accuracy of financial records.

- Management Letters:These letters communicate the auditor’s observations and recommendations to management. They highlight areas of concern, potential risks, and suggestions for improvement in internal controls and financial reporting.

- Audit Findings Letters:These letters document specific findings and discrepancies identified during the audit. They provide detailed explanations of the issues, their potential impact, and recommendations for corrective action.

- Audit Completion Letters:These letters formally communicate the auditor’s opinion on the fairness of the financial statements. They summarize the audit findings and provide an overall assessment of the organization’s financial health.

Common Audit Letter Formats and Structures

Audit letters typically follow a standard format to ensure clarity and consistency. Common elements include:

- Letterhead:The letterhead includes the auditor’s name, address, and contact information.

- Date:The date of the letter indicates when it was prepared and sent.

- Recipient:The letter is addressed to the appropriate recipient, such as the organization’s management or a specific individual.

- Subject:A clear and concise subject line summarizes the purpose of the letter.

- Body:The body of the letter contains the specific content and information relevant to the audit engagement.

- Closing:The closing includes a polite closing phrase, such as “Sincerely” or “Best regards,” followed by the auditor’s signature and printed name.

Letter 2645c: Is Letter 2645c An Audit

Letter 2645c, issued by the Securities and Exchange Commission (SEC), is a significant communication that addresses the auditing of internal control over financial reporting (ICFR) for publicly traded companies. It Artikels the SEC’s expectations for auditors in performing ICFR audits and provides guidance on the application of auditing standards.

Regulatory Context and Guidelines, Is letter 2645c an audit

Letter 2645c is a key document in the SEC’s regulatory framework for ICFR audits. It is rooted in the Sarbanes-Oxley Act of 2002 (SOX), which mandated that public companies establish and maintain effective ICFR and that their auditors provide an opinion on the effectiveness of these controls.

The letter draws upon the following regulations and guidelines:

- SOX Section 404:This section of SOX mandates that public companies establish and maintain effective ICFR and that their auditors provide an opinion on the effectiveness of these controls.

- Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 5 (AS 5):This standard provides detailed guidance for auditors in performing ICFR audits, including the planning and execution of the audit, the evaluation of internal control deficiencies, and the communication of audit findings.

- SEC Staff Accounting Bulletin (SAB) No. 108:This bulletin provides guidance on the application of AS 5 and clarifies the SEC’s expectations for auditors in performing ICFR audits.

Historical Context and Development

Letter 2645c was issued in 2007 as a follow-up to the SEC’s earlier guidance on ICFR audits. It was intended to provide further clarification on the SEC’s expectations for auditors in performing these audits and to address concerns that had emerged in practice.

The letter’s development was influenced by several factors, including:

- Early experiences with ICFR audits:The SEC’s initial guidance on ICFR audits was relatively broad, and auditors were grappling with the implementation of SOX Section 404 and AS 5. Letter 2645c aimed to address some of the practical challenges that auditors were facing.

- The need for consistency:The SEC recognized that there was a need for greater consistency in the application of ICFR auditing standards across different companies and industries. Letter 2645c provided more specific guidance on how auditors should approach the audit of ICFR.

- Evolving regulatory landscape:The regulatory landscape for ICFR audits was evolving as the SEC gained experience with the implementation of SOX Section 404. Letter 2645c reflected this evolving landscape and provided updated guidance on ICFR auditing practices.

Impact on Financial Reporting and Auditing Practices

Letter 2645c has had a significant impact on financial reporting and auditing practices. It has:

- Enhanced the quality of ICFR audits:The letter’s guidance has helped to ensure that ICFR audits are performed in a more consistent and rigorous manner, leading to improved quality and reliability of financial reporting.

- Increased the focus on internal controls:The letter has increased the focus on internal controls within organizations, as companies recognize the importance of having effective ICFR to ensure the accuracy and reliability of their financial statements.

- Promoted greater transparency:The letter has promoted greater transparency in the audit process, as auditors are now required to provide more detailed information about their findings and conclusions related to ICFR.

- Increased the complexity of ICFR audits:The letter’s guidance has increased the complexity of ICFR audits, as auditors are now required to perform more extensive testing and documentation of internal controls.

Key Components of Letter 2645c

Letter 2645c, formally known as “Understanding Audit Letters,” is a crucial document in the realm of financial audits. It Artikels the expectations and requirements for conducting a comprehensive and effective audit, ensuring that all parties involved are on the same page regarding the scope and objectives of the audit process.

Purpose and Scope

Letter 2645c serves as a comprehensive guide for auditors and auditees, clarifying the purpose and scope of the audit. It establishes a framework for understanding the expectations and responsibilities of both parties throughout the audit process.

Key Components

The following table Artikels the key components of Letter 2645c, highlighting the specific requirements and expectations Artikeld in each section:

| Component | Requirements and Expectations | Examples |

|---|---|---|

| Audit Objectives | Defines the specific goals and objectives of the audit, outlining the areas to be examined and the criteria to be used in evaluating the financial statements. |

|

| Audit Procedures | Specifies the specific audit procedures that will be performed to gather evidence and support the auditor’s opinion on the financial statements. |

|

| Responsibilities of Management | Artikels the responsibilities of management in preparing and presenting the financial statements, including the establishment and maintenance of internal controls. |

|

| Responsibilities of the Auditor | Defines the responsibilities of the auditor in conducting the audit, including the planning, execution, and reporting of the audit findings. |

|

| Communication with Management | Specifies the communication channels and processes for exchanging information between the auditor and management throughout the audit process. |

|

| Audit Report | Artikels the format and content of the audit report, including the auditor’s opinion on the fairness of the financial statements. |

|

Implications for Auditors and Businesses

Letter 2645c, issued by the Public Company Accounting Oversight Board (PCAOB), significantly impacts both auditors and businesses. The letter provides guidance on the auditor’s responsibility for evaluating the effectiveness of a company’s internal control over financial reporting (ICFR). This guidance aims to enhance the quality of audits and improve the reliability of financial reporting.

Implications for Auditors

The guidance in Letter 2645c presents several implications for auditors conducting financial audits. It emphasizes the importance of a risk-based approach to auditing ICFR, focusing on areas that are more likely to be susceptible to misstatements. Auditors are expected to:

- Conduct a thorough assessment of the company’s control environment, including its control activities, risk assessment process, and information and communication systems.

- Identify and assess the risks of material misstatement in the financial statements, considering both financial and non-financial factors.

- Design and perform procedures to test the effectiveness of the company’s ICFR, focusing on areas with higher risk.

- Document their work and communicate their findings to management and the audit committee.

Auditors must also be prepared to provide greater transparency and detail in their audit reports, including a description of their work and the results of their testing. This enhanced reporting is intended to provide stakeholders with a more comprehensive understanding of the auditor’s findings and the effectiveness of the company’s ICFR.

Implications for Businesses

Letter 2645c has significant implications for businesses, particularly in terms of their internal control systems and financial reporting processes. The letter highlights the need for companies to:

- Establish and maintain a strong internal control environment that is designed to prevent and detect material misstatements in the financial statements.

- Develop and implement a robust risk assessment process that identifies and evaluates the risks of material misstatement.

- Document their internal controls and processes, providing evidence of their effectiveness.

- Communicate with auditors about their internal controls and any changes that may affect their effectiveness.

Businesses should also be prepared to respond to the increased scrutiny of their internal controls by auditors. This may involve providing more documentation and information about their controls, as well as being more transparent about their risk assessment processes.

Best Practices for Complying with Letter 2645c

Companies and auditors can take several steps to ensure compliance with the requirements of Letter 2645c. Some best practices include:

- Conduct a thorough assessment of the company’s ICFR:This should include a comprehensive review of the company’s control environment, control activities, risk assessment process, and information and communication systems. This can be achieved by using a risk assessment framework such as COSO or ISO 31000.

- Develop and implement a robust risk assessment process:The risk assessment process should identify and evaluate the risks of material misstatement in the financial statements, considering both financial and non-financial factors. This should involve identifying the key risks and prioritizing them based on their likelihood and impact.

- Document internal controls and processes:Adequate documentation of internal controls and processes is essential for demonstrating their effectiveness. This documentation should be clear, concise, and readily available to auditors. This documentation should be updated regularly to reflect any changes in the company’s operations or control environment.

- Communicate with auditors:Open and transparent communication between companies and auditors is crucial for ensuring compliance with Letter 2645c. Companies should proactively inform auditors of any changes in their internal controls or any potential risks that may affect the effectiveness of their ICFR.

- Provide adequate training to employees:Training employees on the importance of internal controls and their role in maintaining the integrity of financial reporting is essential. This training should cover topics such as the company’s control environment, risk assessment process, and control activities.

Future Trends and Developments

Letter 2645c, while a crucial document for auditors and businesses, is constantly evolving in response to changing regulatory landscapes, technological advancements, and evolving accounting standards. This section explores potential future developments and trends that may influence Letter 2645c and its implications.

Emerging Trends in Auditing and Financial Reporting

The auditing profession is undergoing significant transformation, driven by technological advancements and the evolving nature of business operations. Emerging trends in auditing and financial reporting are likely to impact Letter 2645c, shaping its content and scope.

- Data Analytics and Artificial Intelligence (AI):The increasing use of data analytics and AI in auditing is transforming how auditors gather, analyze, and interpret financial data. This will likely lead to more sophisticated and automated audit processes, potentially impacting the information communicated in Letter 2645c.

For instance, AI-powered tools could be used to identify and assess risks more efficiently, leading to more detailed and targeted information within the letter.

- Cybersecurity and Data Privacy:As businesses become increasingly reliant on technology and data, cybersecurity and data privacy are becoming paramount. This will likely influence Letter 2645c, with greater emphasis on addressing these risks and ensuring compliance with relevant regulations. For example, Letter 2645c may include specific sections dedicated to cybersecurity risks, data privacy practices, and the effectiveness of the company’s controls in these areas.

- Sustainability Reporting:The growing focus on environmental, social, and governance (ESG) factors is driving increased demand for sustainability reporting. This trend will likely influence Letter 2645c, potentially incorporating sections dedicated to the company’s sustainability practices and their impact on financial performance. For example, the letter might include information on the company’s environmental footprint, social impact, and governance practices, as well as the auditor’s assessment of the company’s sustainability disclosures.

Common Queries

What is the main purpose of Letter 2645c?

Letter 2645c aims to ensure that companies provide accurate and transparent financial information. It’s a way to keep them accountable and make sure their books are balanced!

Who is Letter 2645c for?

Letter 2645c is primarily aimed at businesses and their auditors. It sets guidelines for how financial information should be presented and audited.

What are the potential consequences of not complying with Letter 2645c?

Not following Letter 2645c could lead to penalties, fines, or even legal issues. It’s like breaking a traffic law – not good!